Internal Fraud in Telecom: How Big Data Helped Uncover $1 Million in Losses

5 august 2025

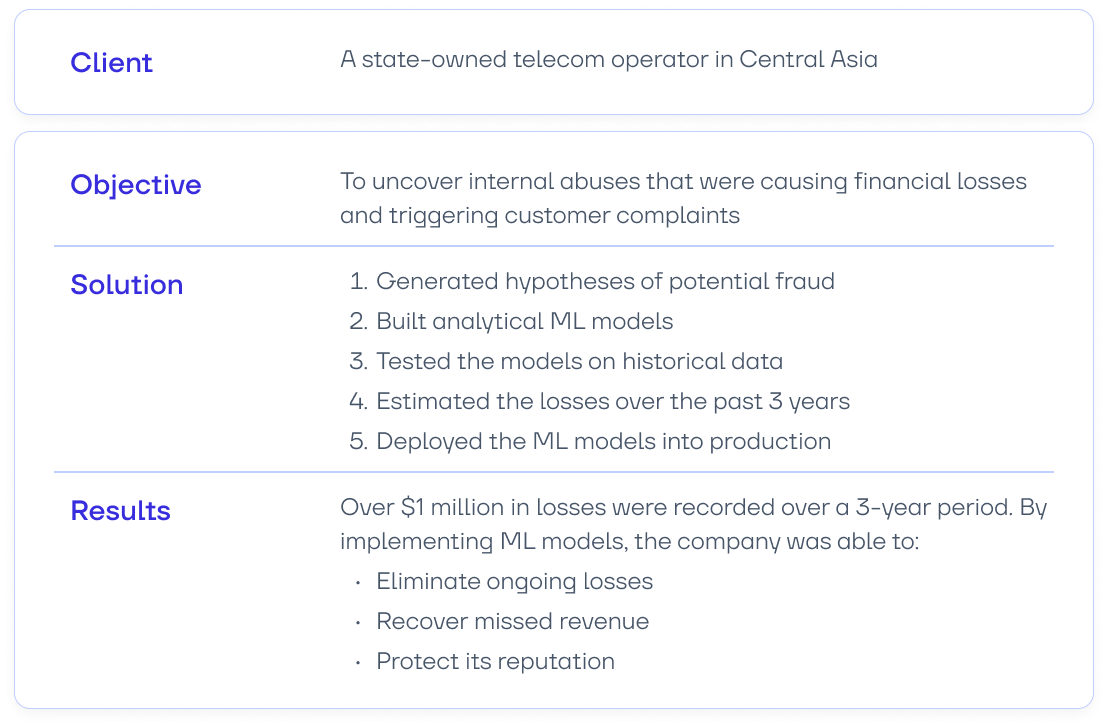

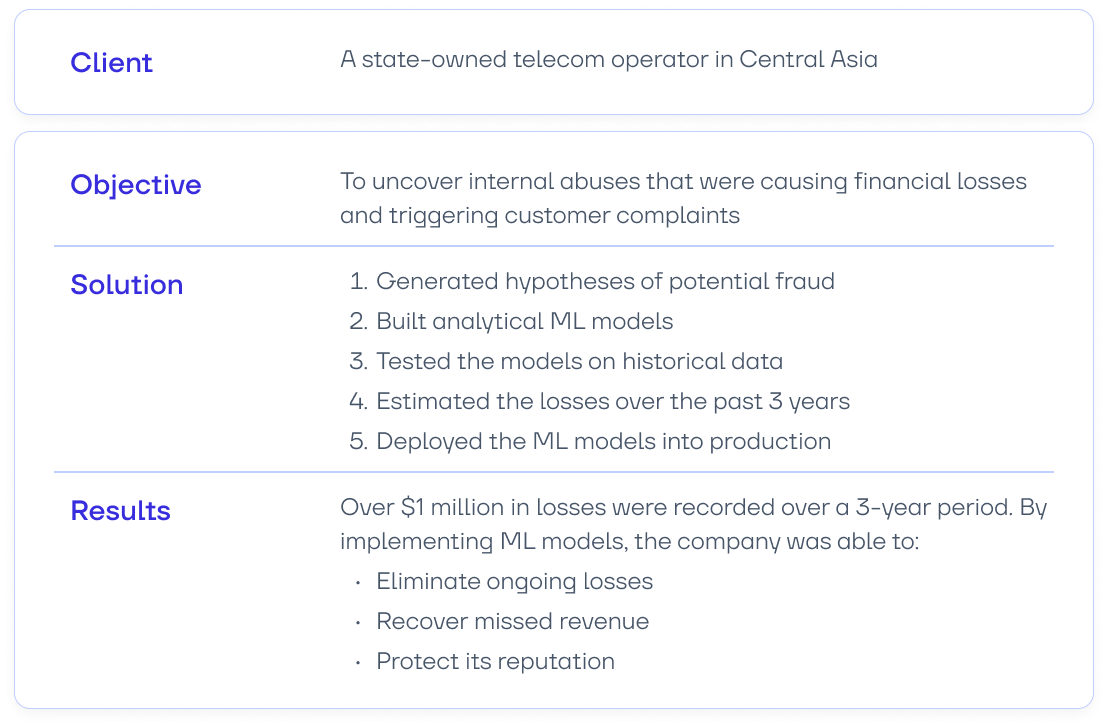

One of the state-owned telecom operators in Central Asia noticed a growing number of customer complaints and suspected that dishonest employees and distributors might be behind the surge. Traditional methods failed to uncover the fraudulent schemes. The breakthrough came with the help of machine learning analytics. Read our case study to find out how the mobile operator put an end to internal fraud.

The implementation of analytical models to combat fraud led to a reduction in questionable accounts receivable, helped prevent unjustified charges, and mitigated the risk of legal expenses.

The issue wasn’t external cyber threats, but internal fraud—committed by distributors, sales agents, and employees of the telecom operator. These actions were difficult to detect with standard monitoring systems, yet they caused significant damage to the business:

The challenge was compounded by the fact that, at the outset, there was no clear understanding of the specific fraud schemes being used.

The Eastwind team provided expert support to the mobile operator, helping analyze large volumes of data and develop machine learning models.

To move from assumptions to data-driven insights, we began by generating hypotheses:

Relying on analytics, we uncovered dishonest employee schemes and developed mechanisms to neutralize such threats.

How Big Data Analytics Helps Businesses Boost Profitability

Out of the 30 ML models developed to detect and prevent abuse, four demonstrated high accuracy and clear business impact. These models helped eliminate several key types of internal fraud:

SIM card registration on high-value customers. Sales agents registered SIM cards to customers with high ARPU and then passed those cards to third parties. The real customer’s balance was charged for services they weren’t using—often until they noticed irregular charges and contacted the operator themselves.

Selling bundled plans without the promotional SIM card. Under the promotional offer, customers who signed up for a new SIM card were supposed to receive a second SIM with a bundled plan as a gift. Distributors deliberately withheld this information, activated the second SIM in the customer's name, but kept it for themselves or gave it to friends or family. As a result, the honest subscriber paid for services they never used.

Misappropriation of unused balances. When a customer switched to another provider, unused funds often remained on their account. According to company policy, these funds were to be written off as other revenue after a set period. However, some employees abused their access by transferring these remaining balances to accounts belonging to acquaintances in order to cover their debts.

Mass activation of VAS services without customer consent. To meet sales targets, employees enrolled customers in low-cost value-added services (VAS) without their knowledge. The small deductions usually went unnoticed and triggered few complaints, but on a large scale, they generated significant revenue and helped staff hit performance KPIs. This posed a major reputational risk had the fraud become public.

The next step was to assess the financial impact of these fraud schemes.

To assess the scale of the damage, we tested the models on retrospective data covering the past three years. The results showed that losses from the identified fraud schemes had exceeded $1 million. The model’s calculations were later confirmed by the company’s internal audit.

Fraud prevention cases were rolled out within a year.

To eliminate internal fraud, it wasn’t enough to simply uncover the fraudulent schemes—we also needed to understand their scale and root causes. That required a solution that would work in real-world conditions, not just tick boxes in a compliance checklist. Machine learning models met this challenge effectively:

The Eastwind team helped the mobile operator turn a massive pool of analytics into business value: safeguarding revenue, reducing customer complaints, and increasing process transparency.

Book a consultation to learn how big data can help uncover hidden risks and revenue losses in your business.

More News

The implementation of analytical models to combat fraud led to a reduction in questionable accounts receivable, helped prevent unjustified charges, and mitigated the risk of legal expenses.

Client’s Request

The issue wasn’t external cyber threats, but internal fraud—committed by distributors, sales agents, and employees of the telecom operator. These actions were difficult to detect with standard monitoring systems, yet they caused significant damage to the business:

- Financial: A portion of the revenue from sales never made it into the operator’s budget

- Reputational: The number of customer complaints was steadily increasing

The challenge was compounded by the fact that, at the outset, there was no clear understanding of the specific fraud schemes being used.

Our Approach to Solving the Problem

The Eastwind team provided expert support to the mobile operator, helping analyze large volumes of data and develop machine learning models.

To move from assumptions to data-driven insights, we began by generating hypotheses:

- Analyzed several dozen potential fraud scenarios

- Identified over 20 scenarios that warranted deeper investigation

- Built more than 30 analytical models focused on fraud prevention

Relying on analytics, we uncovered dishonest employee schemes and developed mechanisms to neutralize such threats.

How Big Data Analytics Helps Businesses Boost Profitability

Types of Internal Fraud We Identified

Out of the 30 ML models developed to detect and prevent abuse, four demonstrated high accuracy and clear business impact. These models helped eliminate several key types of internal fraud:

SIM card registration on high-value customers. Sales agents registered SIM cards to customers with high ARPU and then passed those cards to third parties. The real customer’s balance was charged for services they weren’t using—often until they noticed irregular charges and contacted the operator themselves.

Selling bundled plans without the promotional SIM card. Under the promotional offer, customers who signed up for a new SIM card were supposed to receive a second SIM with a bundled plan as a gift. Distributors deliberately withheld this information, activated the second SIM in the customer's name, but kept it for themselves or gave it to friends or family. As a result, the honest subscriber paid for services they never used.

Misappropriation of unused balances. When a customer switched to another provider, unused funds often remained on their account. According to company policy, these funds were to be written off as other revenue after a set period. However, some employees abused their access by transferring these remaining balances to accounts belonging to acquaintances in order to cover their debts.

Mass activation of VAS services without customer consent. To meet sales targets, employees enrolled customers in low-cost value-added services (VAS) without their knowledge. The small deductions usually went unnoticed and triggered few complaints, but on a large scale, they generated significant revenue and helped staff hit performance KPIs. This posed a major reputational risk had the fraud become public.

The next step was to assess the financial impact of these fraud schemes.

What the Analytics Revealed

To assess the scale of the damage, we tested the models on retrospective data covering the past three years. The results showed that losses from the identified fraud schemes had exceeded $1 million. The model’s calculations were later confirmed by the company’s internal audit.

Fraud prevention cases were rolled out within a year.

Why This Approach Worked

To eliminate internal fraud, it wasn’t enough to simply uncover the fraudulent schemes—we also needed to understand their scale and root causes. That required a solution that would work in real-world conditions, not just tick boxes in a compliance checklist. Machine learning models met this challenge effectively:

- Flexible analytics detect fraud in real-world settings, not just through predefined checklists like standard business process audits

- ML models are trained on historical operations, transactions, and user behavior, enabling them not only to detect fraud but also to predict and prevent it in the future

- Big data makes it possible to assess both direct losses and missed revenue opportunities—for example, when customers lost access to paid services or churned early due to poor experiences

The Eastwind team helped the mobile operator turn a massive pool of analytics into business value: safeguarding revenue, reducing customer complaints, and increasing process transparency.

Book a consultation to learn how big data can help uncover hidden risks and revenue losses in your business.